On air schedule

Mon-Fri: 7:00 PM - 12:00 AM

Mon-Fri: 6:00 AM - 10:00 AM

Mon- Fri: 10:00 AM - 3:00 PM

Mon-Fri: 3:00 PM - 7:00 PM

Music News

Spike Lee shares trailer for ‘Highest 2 Lowest’ starring Denzel Washington, A$AP Rocky

- June 30, 2025 4:20 am|

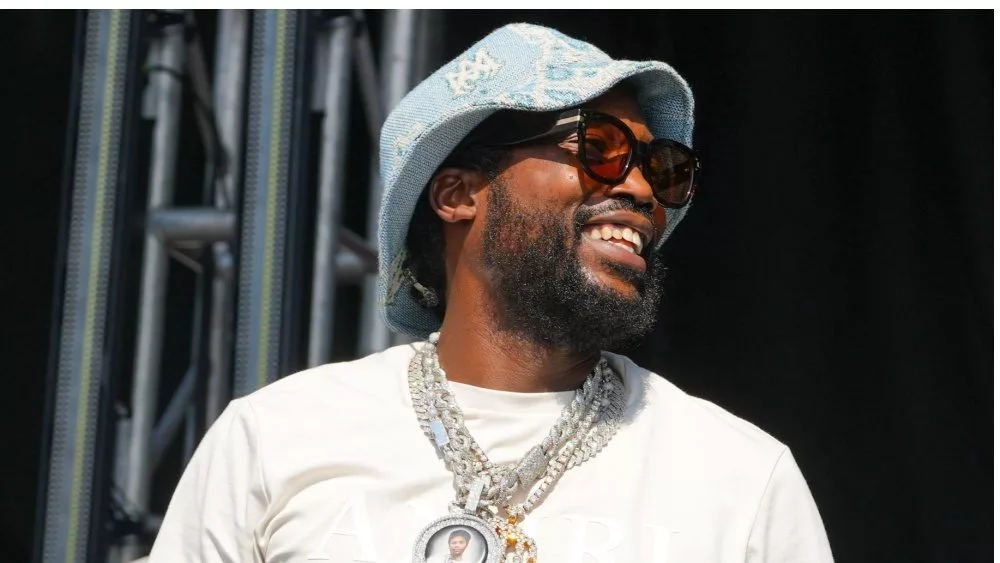

Meek Mill shares video for ‘Survivor’s Guilt’ feat. G Herbo

- June 27, 2025 4:00 am|

The Weeknd shares video for ‘Baptized in Fear’

- June 27, 2025 3:50 am|

Entertainment News

See the first trailer for ‘Wicked: For Good’ starring Ariana Grande and Cynthia Erivo

- June 27, 2025 4:20 am|

Prosecutors to drop some charges in case against Sean ‘Diddy’ Combs

- June 26, 2025 5:05 am|

Pete Davidson stars in the trailer for horror-thriller ‘The Home’

- June 26, 2025 4:20 am|

James Marsden joins cast of Season 2 of ‘Your Friends & Neighbors’

- June 25, 2025 4:20 am|

It looks like you are not a member of VIP Club yet. Please fill out the form below to access the page and join the VIP Club